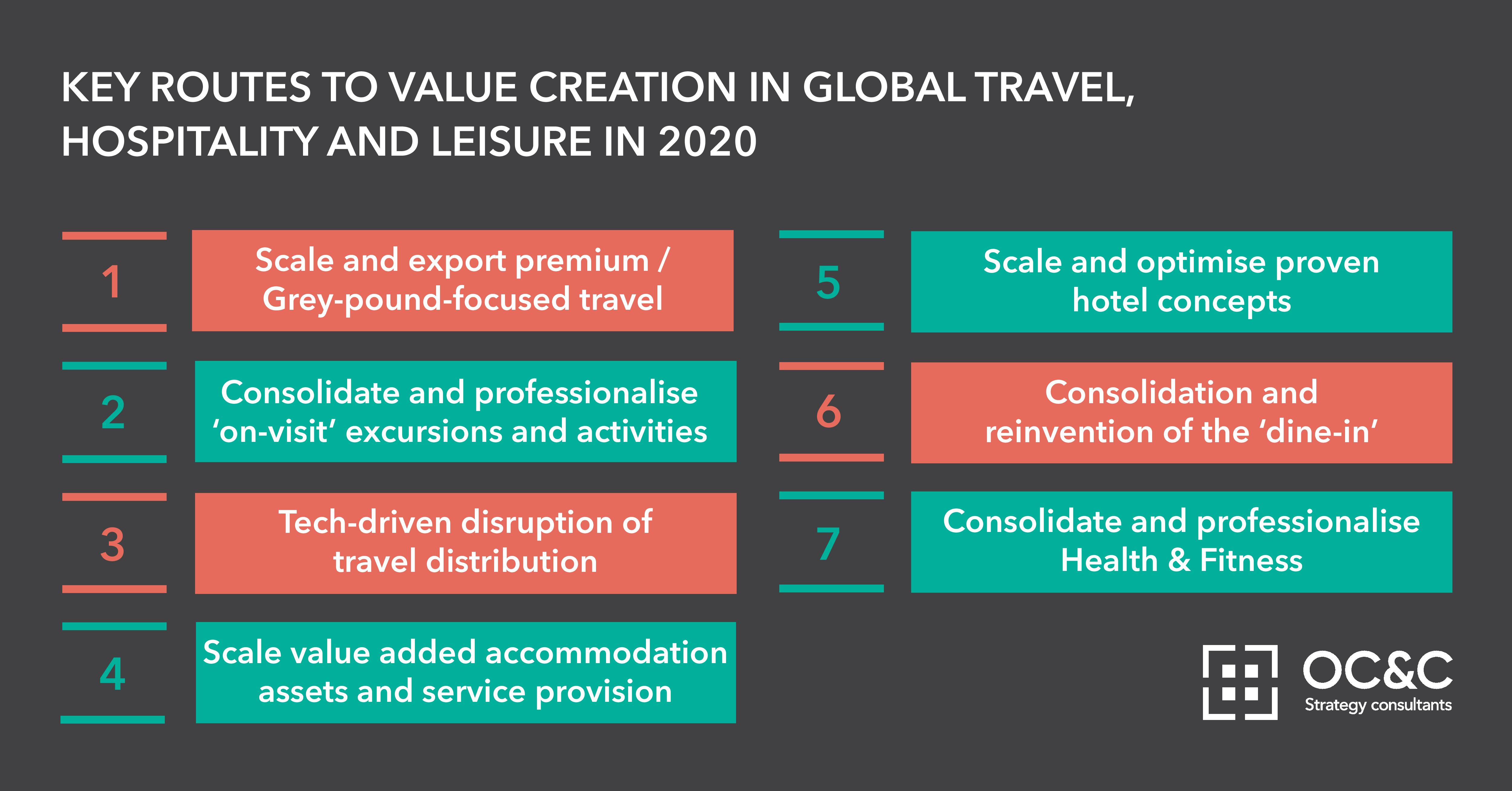

Key routes to value creation in global travel, hospitality and leisure in 2020

2020年2月20日文章

As we enter 2020, we continue to see strong interest and activity across a number of key leisure trends – and a number of highly attractive assets that are successfully playing into these themes to drive growth. Whether corporate, investor, or bank – here are the seven key themes you should be paying attention to in global leisure:

As we enter 2020, we continue to see strong interest and activity across a number of key leisure trends – and a number of highly attractive assets that are successfully playing into these themes to drive growth. Whether corporate, investor, or bank – here are the seven key themes you should be paying attention to in global leisure:

- Scale and export premium / Grey-pound-focused travel

As global travel spend is growing, premium travel agents and operators are successfully tapping into the affluent grey market by providing a more personalised holiday experience. Their ability to address an attractive customer segment with higher willingness to pay for service, often with strong brand recognition and word-of-mouth recognition is enabling the scaling and internationalisation of these propositions. - Consolidate and professionalise ‘on-visit’ excursions and activities

For many years, little attention was paid to ‘in trip’ leisure spend on excursions and activities; however this is changing rapidly. With many of the local experience providers having limited scale, there is space to professionalise the local market experience and disrupt current distribution and service provision models. This has attracted a number of rapidly growing platforms, as well as established global players - as seen by TUI’s acquisition of Musement in 2018. - Tech-driven disruption of travel distribution

The continued growth of digital has opened the door for meaningful disruption in travel distribution for under-exploited sub-segments through technology innovation. From Flixbus revolutionising the European mid- and long distance coach market, to specialised OTAs such as Lastminute.com and Secret Escapes, there is plenty afoot in this space. - Scale value added accommodation assets and service provision

Hotels may account for large proportion of accommodation spend, and AirBnB for a large share of headlines, but there are more interesting areas for value creation: Value-add concepts such as holiday parks offer plenty of opportunity to consolidate and scale assets popular with domestic/short haul holidays. - Scale and optimise proven hotel concepts

No frills and high customer ratings – while not an easy balance, there are a number of hotel concepts that have been able to balance delivering the basics extremely well with a cost-effective operating model. There remains significant headroom to consolidate and scale these hotel concepts that have been successful in capturing market share. - Consolidation and reinvention of the ‘dine-in’

There is changing of the guard in casual dining. As consumer behaviours are changing (growth of delivery, decline in out-of-town footfall, changing menu preferences), we are seeing new formats disrupt the status quo in dine-in, and established players using M&A to ensure continued relevance – and use their experience and access to property to help scale and internationalise successful concepts. - Consolidate and professionalise Health & Fitness

The last decade has seen strong growth of gym chains both in their domestic and international markets. As these markets have become more penetrated, focus is increasingly shifting to geographies that are immature or have a long tail of unsophisticated competitors; as well as to health concepts that are offering stronger community element – with winning concepts able to scale these propositions and operating platforms.

If you want to know more about how these trends are playing out, and how they could help you realise value and drive growth, please contact our Leisure team.