Fortunes to be won or lost for food and drinks suppliers

Friday 23 October 2020 | Press releaseThe UK’s biggest 150 food and drink producers saw a return to stability in 2019 but in 2020 and the year ahead, there will be big winners and big losers

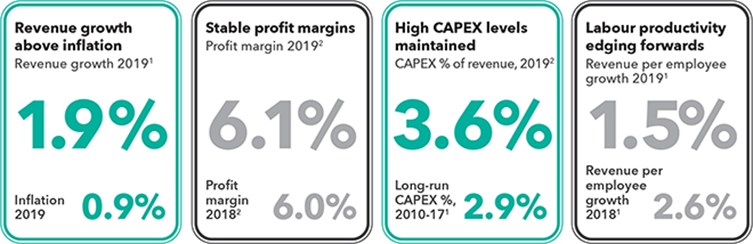

- 2019 was expected to be a difficult year for food and drink suppliers but with Brexit delayed and a robust economy, it will be looked back on as a period of stability and solid progress, with the top 150 growing ahead of inflation at 1.9% and profit margins edging forwards to 6.1%

- 2020 and the year ahead are full of challenges, with the impact of Covid likely to be felt into the medium-term, especially as the recession bites, along with the looming prospect of a bumpy Brexit

- While obstacles for suppliers are inevitable in this time, disruptions of this magnitude are catalysts for change – in the last recession (2008-10) we saw 2.4x as much share change as in stable years (2017-19)

2019 highlights

The UK food and drink sector showed steady performance in 2019, with revenue growth above inflation at 1.9% (vs. inflation at 1.0%), and profit margins edging forwards to 6.2% (vs. 6.1% in 2018). Under the surface of this, there was varied performance across the 150, with focussed privately-owned businesses and PE-backed businesses enjoying stronger growth than their peers (at 4.7% and 3.2% respectively). On the flipside, large brands have continued to expand and improve margins, with margins now at 9.7%, the highest level since 2010.

The industry has also continued to keep capital spend at a high level in 2019, with capital expenditure at 3.6% of revenue (vs. 2.9% long-run average in 2010-17), driving automation in the face of higher labour costs and continued Brexit uncertainty.

2019s winning performers include Premier Foods and Lucozade Ribena Suntory who stood out for showing clear signs of successful turnarounds, while Lindt and Betty’s and Taylors stood out for exploiting trend-backed growth in their categories by investing and innovating where consumer interest was strongest. David Wood foods, a new entry to the 150, also emerged as a winner this year, on the back of a strategy based on acquisition and turnaround of distressed food businesses (primarily in bakery) with targeted NPD to expand into vegan.

Will Hayllar, UK Manging Partner at OC&C Strategy Consultants, comments: "While 2019 wasn’t spectacular for food and drink companies in the UK, it was relatively stable – something which has been elusive to the top 150 for quite some time. There was a real sense that companies were starting to get on with things in spite of continued pressure from labour costs and uncertainty around Brexit. I think many in the industry will look back to 2019 as the peak of a cycle ahead of the disruption to come."

2020 and the year to come

2020 has already been a tumultuous year. Covid-19 has driven huge changes across the consumer goods industry; with major channel shifts from offline to online and out of home to in-home, in the relative appeal of different categories and brands to address changed consumer need-states, in the resilience sought within supply chains, in the importance of balance sheet strength, and in thousands of operational details to enable the industry to successfully function through different stages of lockdown.

Looking forward, the uncertainty is set to continue in the year to come. Covid recovery looks set to come over an extended period, with significant pressure on consumer incomes as the recession bites. As negotiations with the EU go down to the wire, there continues to be potential for a bumpy Brexit, which could drive significant inflation due to tariffs and depreciation of the pound. Indeed, macroeconomic recovery in the UK is projected to take longer than many other developed markets.

Suppliers will continue to face challenges from multiple fronts – recessionary spending patterns, grocer emphasis on value, shifting consumer needs, continued labour challenges and Brexit driven inflation to name but a few.

Nilpesh Patel, Associate Partner at OC&C Strategy Consultants, comments: “Over the past few months suppliers have had to adapt in ways they had never conceived or planned for. While it’s true that the next year holds significant challenges for food and drink suppliers, there are opportunities for the brave and the bold. We are at a unique point in that food and drink at home is regaining relevance with consumers as their other options – holidays and eating out, for example – reduce."

"Companies focussing on aspirational but accessible products stand to do well, particularly when positioned behind key trends, such as healthy eating, scratch cooking or affordable indulgence. We know from the last recession that disruption provides a catalyst for change, creating larger than ever gaps between winners and losers. We would expect to see a similar, if not greater impact this time round."

The question is, are you positioned to be one of the winners?

Click on the image below to view the OC&C Food & Drink Top 150 2020 infographic.