Return to the road

Thursday 04 June 2020Article

As the world cautiously ventures back outside after weeks in lock down, vehicles are starting to return to previously empty roads. But rubber returning to the road does not mean usage and traffic will immediately bounce back to normal. The return will take time to ramp up, and usage patterns are likely change, possibly significantly, at least until the threat of COVID-19 goes away. And this has big implications for how many of our automotive services clients are organising themselves through the next phase of the crisis.

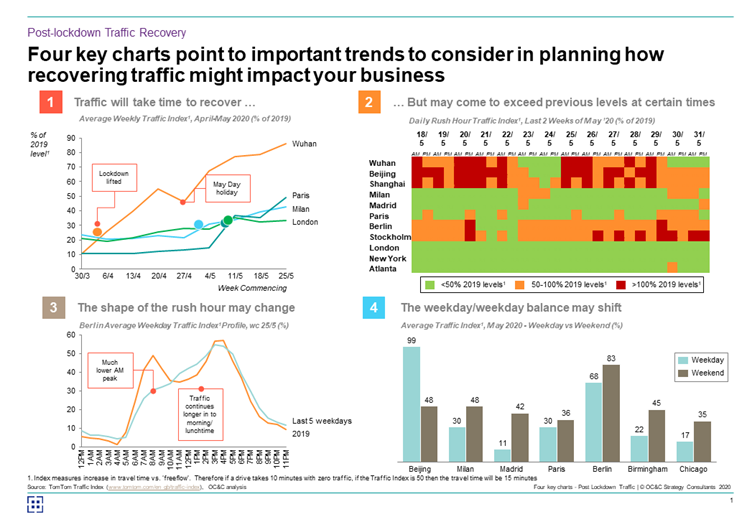

We’ve recently been looking at some interesting data from TomTom’s City Index (which uniquely includes Chinese cities who are further ahead with removing restrictions) to try to divine what might happen as the lockdown eases. We’ve boiled down some of the initial findings to four key charts:

- The return won’t be instant …

- … but over time traffic volume may grow to exceed normalised levels, possibly quite significantly

- The shape of rush hour peaks within a day may change as driver habits adjust …

- and equally the normal weekend/weekday balance may shift significantly

There several different auto service business models which will be impacted by this:

- Mileage driven: Volume of miles is the key driver – e.g. Insurance, Repair shops, Parts, Fuel

- Traffic driven: Congestion is a key cost driver – e.g. Logistics, Taxis, Field Forces

- Mileage+Traffic driven: Volume drives opportunity, but congestion drives cost – e.g. Roadside Assistance, Glass repair, Tyres

- Trips driven: Revenue or cost driven by volume of trips – e.g. parking.

Many of our clients are already engaged in quickly working to understand how traffic will build back up and what the implications are. This is not straightforward, and getting it wrong can mean significant additional costs, lost revenue, or in the worst case both.

- Too much resource is added too early unnecessary cost will be incurred

- Too little resource added revenue opportunities may be lost

- Right overall resource, deployed at the wrong time of day/day of week for new traffic patterns will both incur additional cost and lose revenue opportunity

Time will tell how material, and how permanent, changes to traffic patterns will be, but the impact on many of our clients will be significant. We’d love to chat about how you’re responding and share our thinking.