Opportunities & New Frontiers in Pet

Thursday 19 January 2023Report

Pets have long been comforting companions, with many owners considering them cherished parts of the family.

This love of pets has stimulated a robust category that shows no signs of stalling.

Today, pet is well-established and resilient, with a track record of long run-growth, reinforced by high margins and room for further innovation.

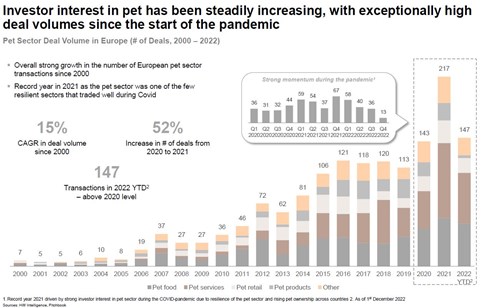

The European sector has seen strong deal growth since 2000, with 2021 being a record year - a surge partly attributable to the pandemic pet boom.

With these strong and enduring fundamentals, it’s of little surprise investors continue to gravitate to this buoyant category.

In our latest insight, we partner with global investment bank and M&A specialist Harris Williams to dig deep into the market to explore the current landscape, identify new frontiers, shine the spotlight on the rise of sustainability, and assess the latest valuation and transactional impacts of this exciting and evolving category.

Reassuringly resilient

Pet is a resilient category, with attractive underlying growth drivers and continued strong investor interest.

While strategic buyers continue to use M&A as a means of obtaining market share, we’re also seeing increased financial investor activity in the space, driving cross-border deals.

While input cost inflation and the cost of living squeeze are putting pressure on many consumer categories, our research shows owners are protecting spend on their beloved pets over other areas. This continues a pattern of category resilience we have seen before; during the 2008-10 recession, the pet food market experienced strong value growth with trade-up to premiumisation continuing.

As we face into continued macro-economic pressure in 2023, pet players also have tried and test options to protect and create value, for example through pricing, value chain realignment and channel strategy. If played well, there’s the potential to enjoy ‘super-margins’ when the dust has settled and we enter a phase of input cost deflation.

Overall, pet remains a staple for investment.

Sustainable pet ownership

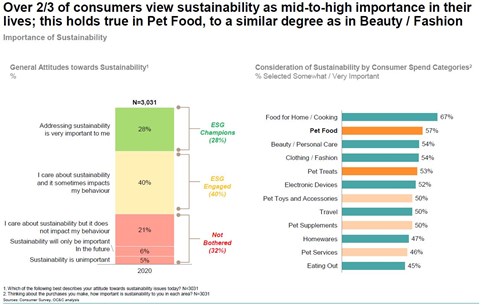

When it comes to sustainability, pet owners are conscious consumers.

Over 2/3rds view sustainability as mid-to-high importance in their day-to-day lives, and the same rings true specifically for Pet Food, with 57% ranking it as either somewhat important or very important when making a purchase.

That said, quality and value are the ultimate drivers when deciding what pet food to buy, with nothing ranking higher in importance than pet enjoyment.

While for now, sustainability isn’t a significant driver of behaviour, we expect this to evolve. Savvy brands will not be complacent and will instead weave ESG priorities into their strategic agenda now.

Unleashing new opportunities

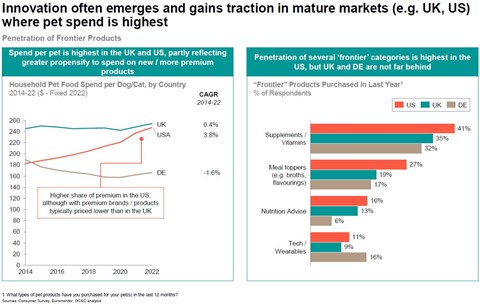

One compelling case for pet is its continued capacity for innovation and premiumisation, and the growth opportunities this unleashes.

Mature markets such as the U.K. and U.S. are well primed for innovation given their consumers’ substantial spend in the category.

From developing super-premium food categories and scaling brands across health and supplement ranges, to focussing on Pet Services and their associated digital offerings, the category offers diverse new frontiers for those ready to fill the white space.

Valuation and transaction impact

For valuations, the trend is positively upward.

Valuation levels of pet sector transactions have steadily increased since 2013, with Pet Services and Pet Food achieving the highest.

Even during the current economic uncertainty premium businesses with well-articulated equity stories can still achieve premium valuations.

Pet brands seeking investment or those looking for M&A opportunities should focus on equity stories that are long term (10+ years) in nature and make sure they can back up their opportunities with data.

Strong credentials

Surging pet ownership, high margins and a history of resilience through downturns - bolstered by continued premiumisation and new product development opportunities make for strong credentials.

For those with an appetite for growth and a desire to come out winning, now is the time to consider the next move in this dynamic category.

To help you plan your medium and long-term strategy in Pet, request our full insight today.

OC&C contacts: