7 key reflections for the retail sector

Monday 06 February 2023Article

Despite a period of undeniable economic and political turbulence, the retail sector has performed resiliently, with spend holding up stronger in Q4 than many had feared.

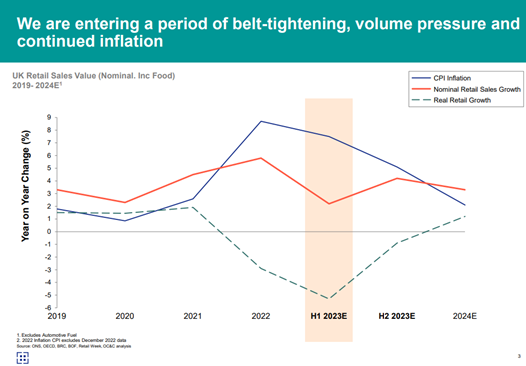

However, consumer confidence remains at an all-time low, and with continued inflation, labour shortages and supply chain challenges, retailers now face a period of belt-tightening. The next 6-9 months will be harder than the last.

As we discussed in our previous article, the retailers that most adeptly navigate these challenges will have a clear sense of how best to protect, and even grow, their margins through unpredictable and volatile conditions. They will also ensure right sizing on the down swing and will be fast to seize the opportunity from the anticipated volume recovery that follows as we enter the autumn.

Since then, we’ve spoke to industry leaders to hear how they believe the next 12 months will play out, strategic priorities for this uncertain period, and how retailers balance both near and long term objectives in this climate. This has revealed 7 important reflections for the retail sector as it navigates the choppy seas ahead:

1. Squeezed middle: while retail spend overall has been surprisingly resilient to date, there are clear sectors and customer segments that have been feeling the pinch most acutely. Most notably, the middle-income segments have little support from savings and are feeling the squeeze of costs outpacing income growth. Some shifting patterns of behaviour might be cushioning this – declining commuting spend, reduced energy consumption, etc – but expectation is the consumer will continue to feel the squeeze.

2. A crisis of confidence: consumer confidence is at a 50-year low, and by most historic correlations this should be driving a far worse economic outcome than it is. This may be due to concerns over war in Ukraine and the global pandemic, which are impacting overall confidence but not economic behaviour specifically.

3. Trust from value: trust has continued to rise in importance for consumers and the major driver of this is value perception. Value is not all about price, which means there are smart ways to drive this forward aside from margin investment. In fashion, thinking about how versatility and durability drive utility is a great example of how smart range design can support strong value credentials. For grocery the discounters are winning share; not simply because of sharp pricing but also because the range allows shoppers to ‘avoid temptation’.

4. Insulate the downside: the first challenge for management teams is to ensure that the business is insulated against downside shocks, both through P&L engineering and shoring up the balance sheet. While there may be some upside from ongoing robust consumer behaviour, capturing this is of secondary importance to protecting against a downswing.

5. Uphill battle for digital: there have been some temporary drags on performance for pure plays (the delivery crisis in particular), which has caused some material swings back to physical retail. These are, however, likely to abate – the shift to ‘profit delivery’ as a KPI for pure plays is causing a radical reassessment of strategy. While the following wind of channel shift has allowed these businesses to focus on top-line growth, this move to profit orientation requires a very different mindset. The operational focus that has prevailed in bricks and mortar for the last decade now needs to be applied to these businesses to start delivering profit.

6. Adjusting for inflation: many business models have not been designed to run in an inflationary environment. This means being able to react in an agile way to shortening patterns of purchase behaviour and rethinking supply chain processes to take advantage of inflation of price vs. cost.

7. Transformation on three fronts: while all of the above will preoccupy the short-term focus, retailers need to continue to deliver transformation on three fronts: delivering on the omnichannel promise; rebuilding sourcing models and de-risking from single point of failure markets like China, and sustainability. Managing this transformation while navigating the choppy waters is going to require real skill and focus.

To find out more about our work in the space, get in touch: