Unlocking Capital in Asia: The New Case for a Hong Kong IPO

For the past few years, the Hong Kong IPO market was in a slump. The once-thriving capital raising hub had seen a dramatic fall in both deal volume and value in 2022, as investor confidence faltered under the combined weight of the pandemic’s aftershocks and ongoing concerns about China’s economic stability. But in 2025, we see a new chapter is unfolding.

The IPO market in Hong Kong is showing clear signs of recovery, with IPO values up to May already matching the total for all of 2024. This resurgence is not just about big names returning to the market such as CATL, a leader in electric vehicle batteries; it also signals a more welcoming environment for smaller companies seeking to raise capital through public listings.

But the decision to go public is never straightforward. As the market opens, companies must carefully weigh their options: Is an IPO the right path, or is private equity funding a better fit? And, importantly, how can they position themselves to ensure a successful listing amidst the inherent risks and volatility of public markets?

A Market Poised for Growth

In the years following the pandemic, the Hong Kong IPO market seemed to lose its sparkle. In 2022, total IPO value had dropped to just US$13 billion, a far cry from the US$43 billion raised in 2021. Global investors, rattled by China’s economic slowdown and lingering geopolitical tensions, shifted their focus elsewhere. And in turn, companies looking to list on the Hong Kong Stock Exchange (HKEX) hesitated, wary of poor market conditions and uncertain returns.

Yet 2025 has brought a surge of optimism. By the end of May, the total IPO value had already hit US$11 billion, almost reaching the entirety of 2024’s total. This recovery is a clear indication that market sentiment is improving, and many are taking notice, seeing this as a unique opportunity to raise capital in a more supportive environment.

Besides the increase in deal value and volume, the recent IPOs are also supported by strong subscription rates and initial price performances, indicating strong investor’ sentiment. Mixue Group, a leading beverage chain in China, listed in March with a strong first-day return of over 40%. BrainAurora Medical Technology, a company specializing in products for the assessment and intervention of cognitive impairments, was listed in January and achieved a first-month return of more than 70%.

Several factors have driven this resurgence. For one, global financial conditions have shifted favorably. Interest rate cuts in major economies and easing trade tensions have brought a renewed sense of confidence among global investors. In China, targeted government policies, including interest rate reductions and cuts to the reserve requirement ratio have injected liquidity into the market and stimulated investor appetite. This has started a shift of global investors’ attitude towards the China economy and hence sentiment about the Hong Kong stock market, where international funds are gradually increasing their position here.

The return of large-cap companies to the IPO stage, such as CATL, is a strong signal that the market is healing, contrasting the previous years where listings were mostly small/micro-cap companies. Sector wise there has also been a diversification. While technology remains a dominant theme, there has been strong momentum in IPOs across retail and food services, healthcare, and industrial manufacturing.

Going Public or Seeking Private Investment

The decision to pursue an IPO is multifaceted. On one hand, the benefits are clear: an IPO can unlock access to a broader pool of capital, often with higher valuations compared to private funding. The visibility that comes with going public is also a key draw, helping companies build their brand and increase their market presence. For early investors or company founders, an IPO offers an exit strategy that can be much more liquid than private equity investments.

However, the drawbacks are also significant. The IPO process itself is typically lengthy and costly. The timeline to listing can take upwards of a year, involving intense regulatory scrutiny, legal fees, and advisory costs. Post-listing, companies must also contend with stringent reporting requirements, investor relations obligations, and the unpredictability of market sentiment.

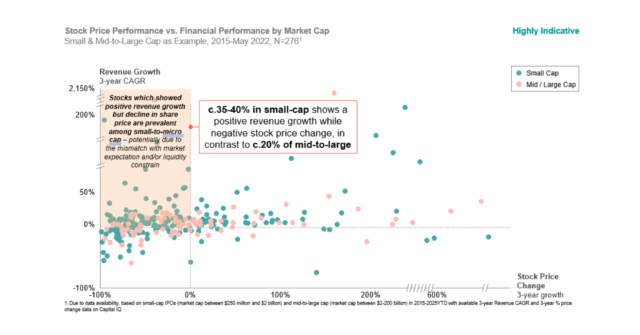

This volatility can be especially challenging for smaller firms. In a market where liquidity is often lower for small-cap stocks, the disconnect between a company’s performance and its share price can be stark.

A study of recent IPOs in Hong Kong found that nearly 35% to 40% of small-cap companies (market cap between $250mn and $2bn USD) showed solid revenue growth but experienced negative stock price movements within the first three years. By contrast, only about 20% of mid- to large-cap companies (market cap between $2bn and $200bn USD) faced this issue.

It’s not surprising, then, that many companies may also look for alternative funding options, including private equity (PE) or venture capital (VC) investment. These options provide faster access to capital with fewer regulatory burdens and no exposure to market fluctuations. PE firms also often offer valuable strategic support, including industry expertise, wider networks to seek resources from, including strategy consultancy. All of this activity supports companies in navigating their next growth phase. However, the trade-off is that private funding generally results in lower valuations and less visibility compared to going public. Also, private sponsors could be very involved in the business, from influencing day-to-day operation to replacing management, whereas the business will be more insulated if listing publicly.

The Key to Success: Preparation and Strategy

As the IPO window opens, companies must carefully strategize to make the most of this opportunity. Successful listings are rarely the result of luck. They require careful preparation, robust financials, and a clear understanding of investor expectations.

The first step is to build a strong and compelling investment case which clearly demonstrates your company’s growth potential, financial health, and market differentiation. Investors are increasingly looking for companies that can demonstrate not only strong performance but also long-term sustainability and adaptability in a rapidly changing market.

In addition to building a solid financial foundation, companies need to cultivate relationships with investors early on. This includes engaging with potential cornerstone investors to gauge their interest and feedback. The more a company can do to demonstrate its value proposition to a broad and diverse investor base, the stronger its position will be in the public market.

Additionally, understanding the nuances of Hong Kong’s IPO process can help companies avoid pitfalls. Reforms to the GEM have made it easier for smaller, high-growth companies with substantial R&D investment to list. Streamlined listing process for A-share listed companies have also made accessing Hong Kong’s capital markets faster and easier.

The Crossroads of Growth

For many companies, the decision to go public is one of the most pivotal in their corporate journey. As the Hong Kong IPO market rebounds in 2025, the opportunity to secure funding, raise their profile, and accelerate growth is more real than ever.

But to seize this opportunity, companies must navigate both the benefits and challenges of the IPO process. The stakes are high, but for companies that are well-prepared and strategically positioned, the rewards can be transformative. The story of Mixue and others shows a success on the HKEX, provided they are ready to meet investor expectations with stable profitable growth and manage the volatility of public markets.

As the market recovers, we are well positioned to support businesses looking to navigate the path to IPO, because it’s who are no longer a questions of whether to act, but when. The IPO window may be opening, but only those with a clear, compelling narrative and a solid strategy will be able to make the most of this moment. Contact our experts today using the buttons below to discuss how we can help you build a path to success in 2025.

Key Contacts

Leo Chiang

Partner