Unlocking Growth in the European Cold Storage Market: Four Strategic Trends Shaping the Future

The European Cold Storage market is undergoing a significant transformation. Shaped by powerful structural drivers, the sector presents compelling opportunities for investors and operators alike. From continued market demand to the advent of automation, four major trends are redefining the landscape. For decision makers, understanding these dynamics is essential to capitalising on the sector’s next wave of growth.

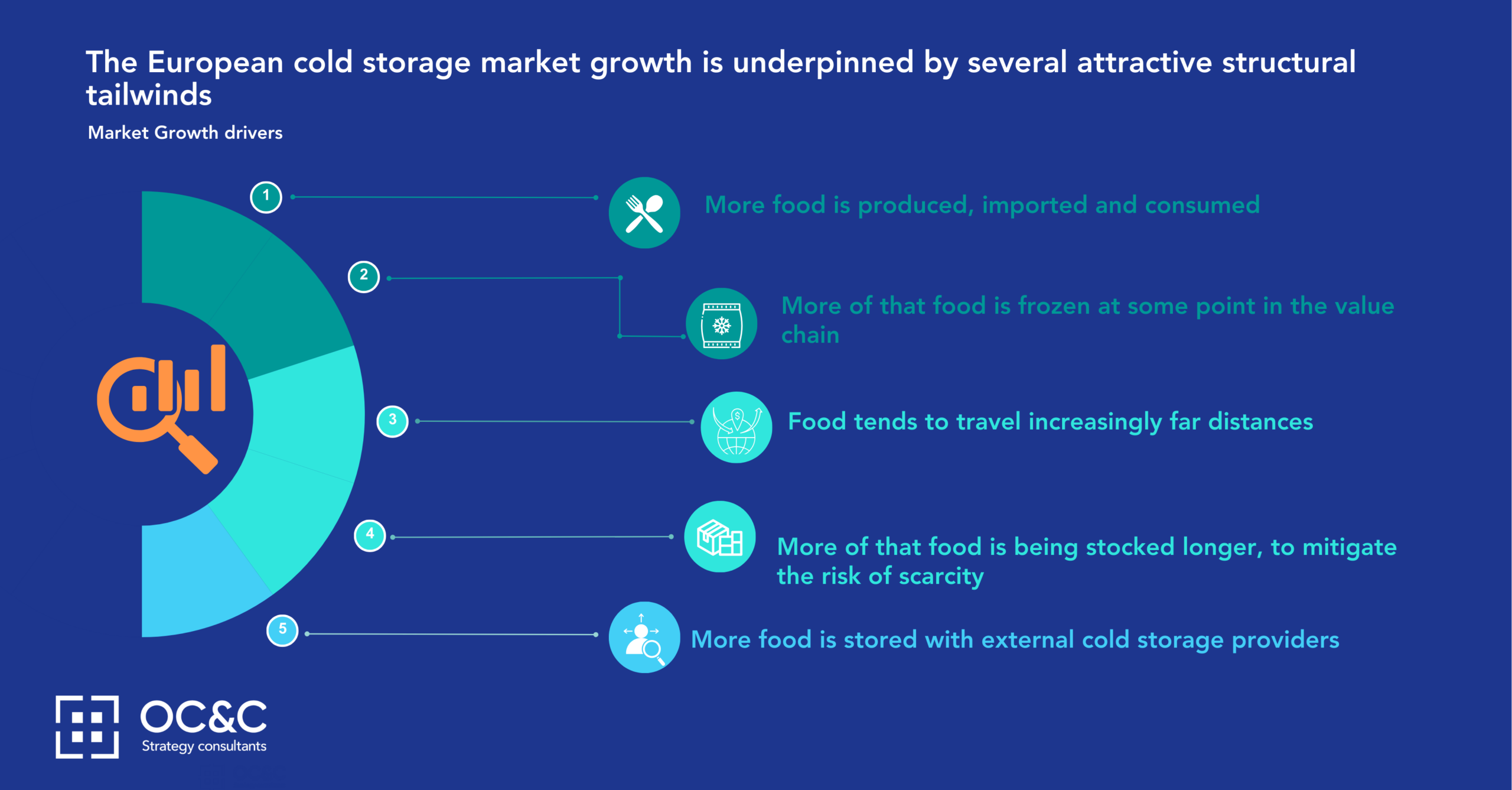

1. Sustained Market Growth Driven by Structural Tailwinds

Our research shows demand for European outsourced cold storage capacity to grow at 5–6% annually, supported by enduring tailwinds such as changing consumer consumption patterns, an increased need for external storage and growing demand for cost effective frozen and chilled products. However, growth is not uniform across the continent. Regions such as Eastern Europe and Iberia are expected to outpace markets like DACH and Southern Europe.

Moreover, not all product categories contribute equally. Segments such as frozen potato products, bakery goods and white meat show significantly higher market potential due to continued growth in production of frozen goods. On the other hand, certain regions that are exposed to production of red meat, especially pork, may experience more challenging demand outlook.

Finally, there is still considerable potential for capacity that is currently being managed in-house by food producers, to be outsourced to cold storage operators. French Fries, bakery goods, ice cream and meat are the most promising product categories to target for outsourcing.

2. Consolidation: Continued Opportunity Despite Maturity

Over the past decade, the European cold storage market has seen significant M&A activity, particularly driven by international platforms pursuing buy-and-build strategies. Yet approximately 40% of market capacity still lies with independent operators, suggesting ample headroom for further consolidation.

The share of independent operators in the market is even higher in Southern, Central and Eastern Europe, and we expect M&A activity to therefore gradually shift to these regions that have been less in focus in the last decade.

The continued consolidation of the market provides opportunities for independents wanting to attract capital to invest or exit. We see tangible advantages for scale players, from commercial synergies and network optimisation to institutionalised M&A processes and improved ESG credentials.

For investors, the opportunity lies in identifying under-the-radar independents with strong local relationships and opportunities for capacity expansion – ideal candidates for platform building or bolt-on acquisition.

3. Professionalisation of Customer Needs and Service Standards

As the food supply chain consolidates and globalises, cold storage operators face heightened expectations. Customers now demand higher service levels, supply chain visibility, and alignment with Environmental, Social and Governance (ESG) standards. Yet, despite growing internationalisation, cold storage remains a local business at its core, requiring a strong regional presence and tailored service offerings:

To remain competitive, operators must invest in capabilities such as certifications, flexibility in operations, and real-time data transparency. For investors, backing businesses that can contribute to professionalisation will be key to building platforms that are integrated and therefore more easily scalable.

4. Automation: A Growing but Selective Enabler

Automation is reshaping the cold storage industry, particularly through the rise of Automated High-Bay (AHB) facilities. The European cold storage market is leading innovation in automation, partly driven by the scarcity and cost of labour. Automation offers cost-effective benefits and has so far been mostly implement in situations where cold stores handle high and predictable volumes of relatively standard-sized pallets and uniform assortments that require little value added services, such as is the case with French Fries or ice cream.

Going forward, we expect that automation will go beyond such situations and also address product categories that less standard, predictable and uniform, such as retail products. This will considerably increase its reach and grow AHB capacity in the coming decade.

However, automation is not a universal solution. Many products – such as fresh produce, dairy, and meat – require a degree of flexibility and value-added services that is still better delivered through conventional facilities. Operators must therefore assess where automation makes economic and operational sense, while maintaining the agility to adapt to a wide range of client needs.

OC&C: Your Strategic Partner in Cold Storage Investment

At OC&C Strategy Consultants, we’ve supported over 40 projects in the cold storage and food logistics sector across Europe and North America. Our deep industry insight, commercial due diligence expertise, and growth strategy capabilities make us the partner of choice for private equity firms, operators, local and global champions who are seeking to navigate this evolving market.

If you’re looking to seize the opportunity in cold storage, get in touch with our experts to explore how OC&C can help you unlock lasting value.

Key Contacts

Casper Roex

Partner

Bram Kuijpers

Partner & Global Head of B2B | Services