After the break… Coming soon from Netflix and Disney+

Even a year ago, Reed Hastings was adamant that introducing ads were not in Netflix’s plan; fast forward to today and we are on the cusp of the worldwide launch of Netflix’s ad-supported plan, “Basic with Ads”, with Disney+ soon to follow. In this article, we examine their market entry plans, particularly for Netflix, as unlike Disney, advertising is a new business line for them. A subsequent article will consider how their entry will impact the advertising market, and in particular, the broadcasters who are the incumbents in TV and professional VOD advertising.

In retrospect, it was the obvious next step for Netflix

Netflix’s about-turn came hot on the heels of their slowing, then actual, drop in subscriber numbers, losing c.1 million subscribers across the first 2 quarters of 2022 – their first subscriber losses since the inception of the streaming service in 2014 [1,2]). For a company reliant on a story of continued growth, it faced increasing competition from Studios pivoting to D2C, a topping out of subscriber growth in developed markets and a limit on the ability to pay in developing markets. On top of this, the Ukraine war has precipitated increasing price sensitivity as customers suffer a cost of living crisis. For Disney+, the introduction of an ad tier feels a much more natural progression given their roots in linear TV and common ownership with Hulu.

For Netflix, introducing Basic with Ads is a way of lowering plan prices to combat price-related churn, as well as attracting new price-sensitive customers – including those who may previously have been ‘sharing’ subscriptions, a practice Netflix has plans to crack down on. The use of a lower-priced ad supported tier as part of a pricing ladder into more premium ad-free options is a tried and tested approach, particularly in the US (as shown in Figure 1). Indeed, Reed Hastings, cited Hulu’s AVOD success (c.$3bn in ad revenue in 2021, growing ad revenue 18% YoY [3]) as a rationale to follow suit. Meanwhile, Disney’s c.77% ownership of Hulu affords them direct experience in understanding the merits of a combined AVOD/SVOD proposition. We note there are only a few significant video streaming propositions available that do not offer an ad-supported tier in the US and UK – Prime Video, ESPN+ and Apple TV+.

So, what do we know of their plans?

News of how Netflix and Disney+ are launching their ad supported tiers has been drip-fed into the market. Here, we put together what we have gleaned from both what we have read and what we have heard. What is clear is that Netflix’s approach reflects their US-centric SVOD roots and its partnership with Microsoft whereas Disney’s reflects its experience and networks in TV advertising globally.

How do we think their plans will land?

Netflix’s adsales approach feels reminiscent of the approach Facebook took when it first introduced advertising. Lacking existing depth of agency and advertiser relationships at the outset, it is leveraging its top-level relationships and brand name to broker global advertising deals and spend commitments with media agencies, which then are cascaded down to individual countries as targets. Netflix – or rather, its adsales partner Microsoft / Xandr, is operationalising at a country level but using a global playbook, naturally developed for the US given the HQ of the organisation and size of the market. Whilst Netflix proclaim that they are “sold out at launch”, whether this will continue at their starting price-points, once the hype has died down, remains to be seen – we have heard that the high minimum spend requirements have been problematic in the context of how even the largest spenders on media determine their budgets between their portfolios of brands.

Netflix’s ad product itself is underwhelming and feels very much an ‘MVP’ to get to market quickly. On the positive side, it has a low ad load of 4-5 mins/hour, comparing favourably to existing services which can reach up to 12 mins/ hour in the UK, potentially more elsewhere. However, at launch there is very limited targeting – limited to ‘top 10 shows’ or ‘genre’, and certainly not audience data-enabled or providing even basic demographic targeting.

A strong positive, however, is Netflix’s understanding of the importance of measurement. Netflix has just announced that they will join BARB, the UK’s industry-owned and trusted audience measurement system used by all agencies and brands, from November 2022, and Nielsen One, an accepted measurement system in the US, some time in 2023. They have also just announced deals with DoubleVerify, and Integral Ad Science, two independent measurement and ad verification providers, to supplement the in-house impression-based measurement offered by Xandr.

What about that high target CPM?

Given the limitations of its product, Netflix’s rumoured target $60-65 CPM, with ambitions for this to rise to over $80, seems hard to justify. This is exceptionally high in comparison to the rates attracted by other professional long-form VOD providers (see Figure 3).

Netflix has said that they are neutral as to whether a subscriber spins down to Basic with Ads, or remains on their existing plan. Los Gatos appears to have set their CPM based on their average US subscriber spinning down to the ad supported tier: Our calculations indicate that the CPM required to make up for a drop in the current average subscription ARPU in the US of $15.95 to the expected $6.99 for the ad tier, is their rumoured target price of $60 – 65.

In reality, we doubt that Netflix subscribers on higher tiers will be as likely to downgrade – the bulk of downgraders are likely be on the basic tier, for which there is just a $3 price differential. In order to recoup the $3 lost subscription revenue from these down-traders, the CPM they need to achieve is much lower, in the $20 ball park, eminently achievable given this is the current levels of CPMs for inventory in less premium, FAST services such as Pluto and Tubi, as well as YouTube with its high proportion of non brand-safe user generated content. Plus, of course, Netflix will benefit from new subscribers attracted in to the lower price point.

In the UK, the story is different again. Netflix viewers in the UK are more prolific in their viewing, and there is a lower (£2) price differential to compensate for. As such, the $65 / £60 CPM price target emanating from the US would more than compensate for the average UK subscriber spinning down to the ad supported tier – we estimate that c. £30 would be sufficient to make them whole. Indeed, again, if a basic tier subscriber were to spin down, a very achievable c. £10 CPM would be sufficient to make them whole.

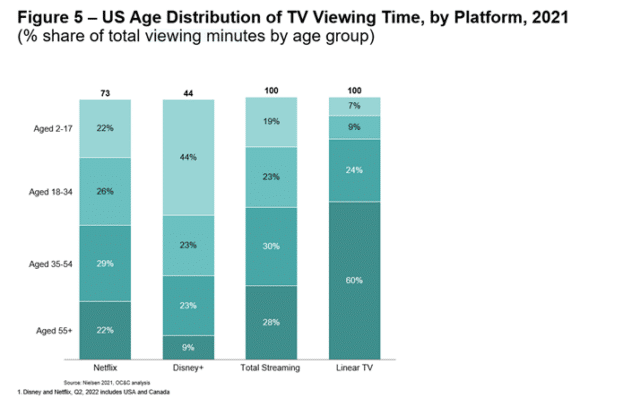

But do we think the high CPMs will be achievable, after an initial period of hype and novelty? A premium would generally be justifiable if they guarantee reaching a great many viewers all at once (ie, high reach) or if they reach particularly scarce / hard to reach audiences (generally younger commercially valuable audiences). With ads constrained to those who opt for an ad tier – with estimates ranging widely from c.10-26m in the US and c.2-5m in the UK – high reach is unlikely to be their USP. We do expect that Netflix and Disney+ audiences will be young given their general audience profile (see Figure 4), and potentially incremental to linear and AVOD viewers, we are less clear on which parts of their subscriber base will opt to spin down to the ad tier.

So – initially, a premium may be initially justifiable if Netflix reaches otherwise hard to reach, valuable customers – BARB can help evidence this in the UK, if Netflix participates in measurement of commercial impacts as well as viewing, but cracking this in the US will be more complex. Additionally, we fully expect Netflix to evolve its advertising product to enable demographic targeting (which will require gathering consent), interest based on other forms of targeting, and first party data matching – and potentially, to push the boundaries of innovation to target ‘mid funnel’ marketing spend currently largely captured by social media and social video.

Finally, Netflix has protected its revenue position through the commercial adsales deal struck with Microsoft, underpinned by high minimum revenue guarantees. Although the deal is still “very early days”, there are clear benefits to both parties. For Microsoft, the deal makes the acquisition of Xandr in late 2021, a programmatic marketplace focused on premium inventory, immediately accretive, and provides a credible entry pathway to the digital video advertising segment.

All in all, we believe that introducing the ad tier will be financially lucrative for Netflix, and they have a lot of leeway to adjust their pricing if they find that their initial high starting point does not generate sufficient buyer interest.

Disney’s approach is more tried-and-tested, given their prior experience of ad-supported streaming in the form of Hulu, and so requires less dissection. The ad product itself strikes us as more sophisticated, with more sophisticated targeting, and is integrated with third party measurement systems (BARB in the UK and Nielsen One in the US, alongside a long-standing partnership with Samba TV). Additionally, their CPM aspirations, whilst high, are lower than the lofty heights of Netflix, at $50.

Our view is that the introduction of an ad tier makes financial sense for these previously exclusively subscription-based providers. They are able to tap into new revenue streams as well as grow their subscriber base. However, what does this mean for current TV and ad-funded VOD providers?

Look out for our next instalment – where we will be examining the potential impact of these moves on the incumbent broadcasters.

If you would like to discuss these topics in more detail, we’d love to hear from you.

About OC&C

We’re a global strategy boutique. We have more than 30 years of experience at unpicking the most complex business challenges with simple, uncommon sense.

We are strategy specialists with deep sector expertise across the consumer goods, retail, leisure, TMT, private equity and B2B services sectors. We work with top management of major multinational corporations, leading national companies and private equity firms and develop winning strategies that have lasting impact.

For all our clients we are uncompromising in our pursuit of delivering gold standard strategies, rooted in deep sector expertise, so that our clients succeed.

[1] Netflix Quarterly Results

[2] Netflix’s subscription losses may be occurring for additional reasons to those cited e.g. MakeUseOf

[3] mediapost.com

Key Contacts

Kim Chua

Partner