Friend or foe? Implications of Netflix and Disney+ ads for broadcasters

Thursday 27 October 2022 | NewsIn our last article, following a slew of announcements, we looked at the advertising market entry plans of Netflix and Disney+, particularly from the perspective of the advertising industry, considered how their ad product might be received.

This article considers the likely effect on broadcaster incumbents in the UK in the medium term and proposes strategies to minimise future revenue risks.

What does this mean for the UK broadcaster revenues?

We have examined and considered the likely impact on the UK advertising market, particularly UK broadcaster advertising revenues, over the next three years. We see three main influences over the outcome:

1. How many subscribers opt for the ad-supported tiers on Netflix and Disney+

2. What average CPMs Netflix and Disney+ achieve

3. Where the money spent on Netflix and Disney+ inventory comes from

Interestingly, the two most credible scenarios both suggest a limited downside for UK broadcasters; Netflix and Disney+ ads curb their future revenue growth, rather than reducing revenues from 2021 levels:

Credible Scenario 1: Damp squib but all substitutional to BVOD / linear TV

Lackluster consumer uptake as most customers don’t find the expected £2 price differential vs the basic plan sufficient to accept advertising. Low and non-incremental audience reach, plus lack of innovation of its ad product, means CPMs are re-priced to match basic non-data enabled BVOD or FAST. This inventory is essentially seen as doing the same job as existing VOD ads from the broadcasters, and so, displaces revenues going to incumbent VOD services.

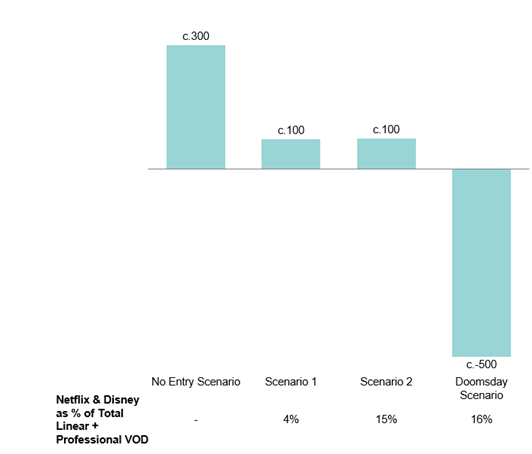

Outcome: Netflix and Disney+ only generate c.£200m in advertising spend between them in 2025. Whilst this comes at the expense of linear and professional VOD advertising spend, the limited traction they have means that spend with incumbents continues on a modest growth trajectory (with c.£100m increase in spend by 2025 relative to 2021), with the value going to Netflix and Disney+ reducing growth rather than resulting in an absolute decline. However, in terms of the linear TV and professional VOD category, this continues to reduce in importance in the overall media mix, attracting 15% of spend vs 19% in 2021.

Credible Scenario 2: Major success, brings new money into TV & BVOD

Netflix actively pushes its ad tier with consumers, seriously backing the development of this new revenue stream to increase ARPUs. They rapidly develop their ad product to provide sophisticated targeting, data matching and other innovations, and persuade hard-to-reach audiences to adopt the ad tier, and evidence this using BARB. They adjust ad tier pricing if necessary to stimulate consumer demand. This justifies their high CPM ambitions. Overall, media buyers are persuaded to invest in Netflix and D+, through diverting spend not just from linear TV and BVOD, but from social video (e.g. YouTube, Facebook, Instagram, TikTok).

Outcome: Netflix and Disney+ make a big splash, generating c.£800m in advertising revenue by 2025, more than all BVOD in 2021. Much of this money comes from reallocations of budgets outside core linear TV and BVOD, increasing the overall advertising spend on linear TV and professional VOD (including Netflix, Disney+) by 2 percentage points versus if Netflix and Disney+ had not introduced ads. This means spend with broadcaster incumbents across linear and BVOD continues to grow modestly (with c.£100m increase in spend by 2025 relative to 2021).

However, there is an outside risk that the introduction of ads by Netflix and Disney+ could result in a significant reduction in UK broadcaster revenues:

Outside risk Doomsday scenario: Major success, but substitutes spend on linear TV & BVOD

This scenario is much like Scenario 2 in terms of consumer take up of the ad tier and actions to justify high CPMs. However, in this scenario, media buyers do not divert any spend from other media – all the spend on Netflix and Disney+ displaces spend on linear TV and incumbent VOD services, perhaps as they continue to be persuaded of the efficacy of other forms of media, over TV and VOD, and the existing TV and VOD ad products either do not innovate and keep up or lose more of their audience attention than currently expected.

Outcome: A bleak picture for incumbents. As in Scenario 2, Netflix and Disney+ generate c.£800m in advertising revenue in 2025, all of which is displaced from what is currently spent on linear and existing professional VOD. This results in the broadcasters losing c.£500m of revenues across linear TV and VOD vs what they have today: linear TV ad revenues contract and BVOD revenues remains static. Additionally, there is no benefit to the overall position of TV and professional VOD in the media mix - as in Scenario one, linear and professional VOD together drops to c.15% of total advertising spend.

Figure 7 – Linear & VOD Advertising Spend by Scenario (£bn)

Source: WARC, OC&C analysis

Figure 8 – Linear and VOD Advertising Spend Excluding Netflix and Disney+, Difference vs 2021 by Scenario (£m)

Source: WARC, OC&C analysis

How can incumbents defend their position?

UK broadcasters cannot influence how Netflix and D+ choose to innovate their ad products, nor can they influence the level of consumer uptake of their ad tiers. However, we think there are three things they should focus on to minimise risk of future substitution by Netflix and Disney+ ads:

Innovate: Develop the ad product to deliver both the top-of-funnel power of brand building enabled by immersive storytelling, with mid-funnel nurturing of interest and consideration through increasingly sophisticated targeting, development of attribution models and other future innovation.

Collaborate: Aim to work with the SVODs to improve the attractiveness of the category. They have joined BARB to report audience viewing; the next step would be to measure and report on commercial impacts alongside other BARB members. Perhaps they may be open to collaborating in premium VOD “walled gardens” to enable buying and planning across VOD providers and linear TV; or campaigning together to communicate the value of advertising in professional video content. Whatever the form of collaboration, the aim would be to work together to give the brands more of what they want, look for ways to increase profitability, and draw in new money to the medium.

Diversify: The scenarios suggest that the introduction of ads in Netflix and Disney+ do limit future growth; and other SVOD providers may follow. Broadcasters should redouble efforts to grow alternate revenue streams and reduce their reliance on advertising – whether linear or VOD.

It is difficult to predict exactly how Netflix and Disney’s entry into the VOD advertising market will play out – but under any scenario, broadcasters should take steps to protect their future position, both in advertising, but also through seeking to grow alternate revenue streams and reduce reliance on advertising.

Whilst this article focusses on the UK, although the details will differ by market, the dynamics are likely to be the same. This is a pivotal moment for the industry – action is key to avoid falling by the wayside.

If you would like to discuss these topics in more detail, we’d love to hear from you.

Kim Chua, Partner

Kim.Chua@occstrategy.com

Duncan Maud, Associate Partner

Duncan.Maud@occstrategy.com